- Assess the damage to property, equipment, and inventory and contact insurance providers, and document all damage.

- Communicate with customers and suppliers to inform them of the situation and the steps to deal with it.

- Create an internal communication plan among stakeholders to allay their fears.

- Inform customers of any changes in service or products.

- Take action quickly to minimize further damage.

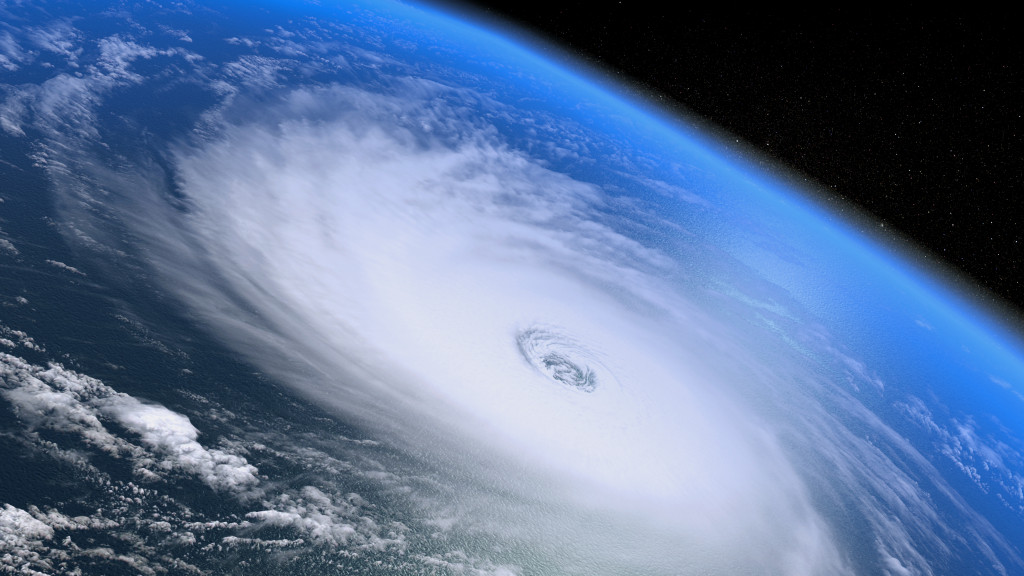

From the beginning of June to the end of November, the country experiences Atlantic hurricane season. A 30-year period from 1991-2020 has shown that in an average year, this time is home to 14 named storms, 7 hurricanes, and 3 major hurricanes. Usually, by mid or late June, a first storm appears. Meanwhile, Eastern Pacific climate periods covering that same timeframe show 15 named storms, with 8 beings hurricanes and 4 being classified as major ones – truly a force of nature! The early and mid parts of June tend to bring about this start each year.

The aftermath of a hurricane can be devastating for businesses. The impact on physical structures, infrastructure, and workforce can be overwhelming, especially for small businesses. Fortunately, several steps impacted businesses can take to restore their operations and resume normalcy. This blog post will outline some steps business owners can take to help them recover from a hurricane.

Assess the Damage

The first step after a hurricane is to assess the damage to your business. You need to determine the extent of damage to your property, equipment, or inventory. It would help if you then prioritized the repairs needed so you know where to concentrate your resources.

Check the Building

For instance, if any windows are broken, you should get an estimate from a reliable commercial glass company. Roofs, walls, and other structural elements of the building should also be inspected for any damage. You’ll need to thoroughly dry out anything that has been affected and then assess the extent of repair work required if there is water damage to your premises.

Check Equipment

Additionally, you should check all of your equipment for damage. Depending on your business type, this may include computers, servers, printers, and other electronic devices. If any of these items have been affected by the hurricane, you must repair or replace them as soon as possible.

Contact Insurance Providers

You should immediately contact your insurance providers after assessing the damage. Your insurers will investigate the damage and help you to file a claim. With flood insurance, your insurance providers should be able to provide you with coverage for any damage to your inventory, property, or equipment.

Insurance Payout

Insurance providers will also send appraisers to inspect your damage and estimate the insurance payout. Be sure to speak with your insurance providers about what is and isn’t covered by your policy. Sometimes, you may need to pay a deductible before coverage begins. Ensure you understand all the details associated with filing an insurance claim for flood damage.

Collect Damage Documentation

After assessing the damage, document everything affected by the hurricane. This includes taking pictures and videos of any damaged items, as well as making an inventory list. This information will be helpful when you are filing a claim with your insurance provider or seeking financial assistance from the government or other organizations.

Communicate with Your Customers and Suppliers

Communicating with your customers and suppliers to inform them of the situation is essential. Inform them of the estimated downtime and the measures you are taking to get back to business. If you have specific supplier relationships or partnerships, contact them as soon as possible to establish a contingency plan. Make sure to provide as much information as possible, as well as open channels of communication for questions.

Internal Communications Plan

Additionally, it’s crucial to create an internal communications plan among your staff and other stakeholders. This ensures everyone knows the situation and what steps are being taken. This will help ease any fears or worries about the safety and stability of the business.

Inform Customers

Finally, keeping your customers informed and engaged throughout the crisis is essential. Keep them updated on any new developments and any changes in service or product offerings due to the disruption. Utilize social media outlets like Twitter and Facebook to create a sense of community and provide useful resources for them during this difficult time.

Recovering from a hurricane can be long and challenging for business owners. However, with the right support and planning, overcoming the challenges and getting back to business as usual is possible. By following these steps, you can minimize the impact of a hurricane on your business and start recovering as quickly as possible. Remember that taking action immediately after the hurricane is important to mitigate any further damage to your business.